Across legal marketing circles, CMOs are wrestling with a question that feels both urgent and unsettling: if AI can mine emails, documents, and meeting notes to surface relationships and warm paths, do we still need a traditional CRM? The promise is compelling. Passive capture, zero manual entry, instant relationship intelligence. But the landscape is more nuanced, and the stakes are higher than most vendors admit.

The near-term answer, based on what's happening across Am Law 200 firms and the broader legal market, is this: AI will not replace CRM as a system-of-record in the next 12 to 24 months. Instead, a governed AI "relationship intelligence" layer will emerge to auto-enrich and reduce attorney admin, while CRM retains its role as the auditable backbone for pipeline, permissions, and reporting.

The state of play

Legal's AI momentum is undeniable. According to the ILTA 2025 Technology Survey, which benchmarks 580 firms representing over 152,000 attorneys, AI integration and core systems planning remain tightly linked in budgeting and strategic roadmaps. Firms are experimenting rapidly, but they're not abandoning the infrastructure that anchors their operations.

At the same time, enterprise AI remains early for end-to-end replacements. McKinsey's 2025 State of AI survey reports that no function has achieved AI deployment "at scale" above roughly 10%, and inaccuracy is the most frequently experienced AI risk. That gap between pilot and production matters when you're dealing with client data, compliance expectations, and executive reporting.

Client diligence is intensifying in parallel. The Thomson Reuters 2025 Legal Department Operations Index highlights heightened scrutiny on outside counsel's AI and data-security practices, with data privacy and accuracy among the top concerns impacting vendor acceptance. The bar for "good enough" governance is rising, not falling.

McKinsey 2025 reports no function has AI "at scale" above ~10%, and inaccuracy is the most frequently experienced AI risk. (Source: McKinsey, November 2025)

Why CRMs underperform in law firms (and why that matters for AI)

I've heard the same story from CMOs at dozens of firms: low adoption, dirty data, and partners who view the CRM as "extra admin" that doesn't align with billable work. The top three barriers are resistance to change, data quality issues with scattered information across systems, and time constraints driven by billable-hour pressure. Add to that attorney concerns about confidentiality and the perception that comprehensive CRM systems might enable overly aggressive sales tactics, and you have a recipe for chronic underperformance.

The structural problem runs deeper. Traditional CRM systems are designed for industries with simpler, transactional customer lifecycles like retail, SaaS and sales, and cannot accommodate the complexities of legal practice, which involves long-term relationships, ongoing case management, and multiple touchpoints across departments. This fundamental misalignment makes CRM feel out of place and cumbersome in law firm settings, contributing to adoption failure.

The implication for AI is critical: if AI simply adds another tool without eliminating manual entry and maintaining governance, the adoption problem persists. Firms need a model that respects attorney workflows and delivers value without adding friction.

Can AI replace CRM or only augment it?

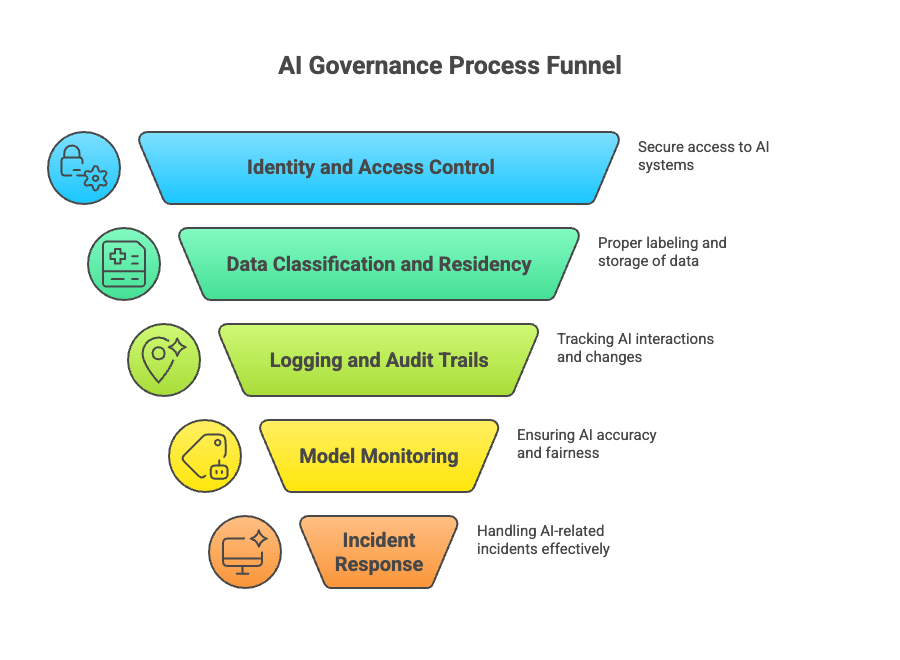

I've posed this question to IT leaders, CMOs, and compliance officers, and the answer is consistent: governance requirements make full replacement unlikely in the near term. Client communications and personally identifiable information require controlled access, logging, and audit trails grounded in recognized frameworks. The NIST Cybersecurity Framework 2.0 and AI Risk Management Framework provide the language and structure for these controls, covering identity and access management, data classification, monitoring, and incident response.

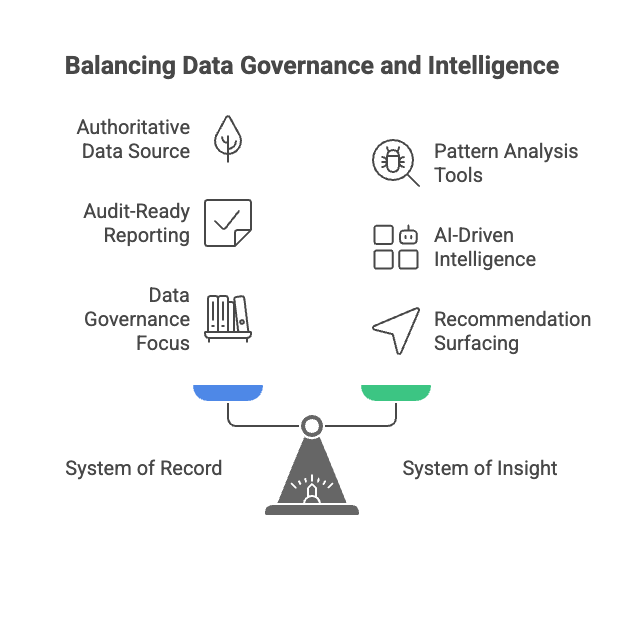

My forecast: over the next 12 to 24 months, AI will act as an enrichment and insight layer on top of CRM, rather than replacing pipeline management, permissions, lineage, or executive reporting. The reason is simple: accuracy, explainability, and lineage remain gating factors for both executive committees and client audits. McKinsey's data on inaccuracy risk and the Thomson Reuters findings on client diligence reinforce this reality.

AI can generate insights, surface warm introductions, and auto-populate contact records. But CRM must preserve the lineage, permissions, and auditability that leadership and clients demand. Firms that try to skip the system-of-record will find themselves unable to answer basic questions: Who owns this relationship? What's our pipeline coverage? How do we reconcile this data for compliance?

Rule-of-thumb: AI can generate insights; CRM must preserve lineage and auditability. (Sources: NIST CSF 2.0; TR LDO 2025)

Near-term shift: From manual entry to passive capture and relationship intelligence

I expect the early wins to come from AI-driven passive capture such as mining emails, meetings, and documents to surface relationships and auto-dedupe contacts, provided outputs reconcile to a governed system-of-record. This approach removes adoption friction by cutting admin and surfacing warm paths without requiring attorneys to change their daily workflows.

Integration, however, remains a challenge. According to AllRize's 2025 Legal Technology and AI Adoption Report (released October 2025), 38.8% of firms report no AI integration with existing applications, while 31.8% have only limited integration. This "shadow AI" adoption, where employees independently download tools, creates security vulnerabilities and complexity, with 52.9% citing resistance to change as a barrier.

I think that firms that deploy AI for enrichment plus dedupe and normalization, tied back to CRM, with usage analytics to prove behavior change, will see measurable wins within 90 days. The Clio 2025 Legal Trends Report found that growing law firms nearly doubled revenue over four years with only a 50% increase in clients and matters, and these firms were significantly more likely to use AI. Among AI users, 36% report positive influence on revenues, jumping to 69% among wide adopters.

38.8% of firms report no AI integration with existing applications; 31.8% have only limited integration. (Source: AllRize/LawNext, October 2025)

Security, client expectations, and auditability

Firms stumble when they underestimate the client bar for AI governance. Legal departments scrutinize AI and data practices, and firms must demonstrate controls for access, monitoring, retention, and residency before AI can touch communications data. The Thomson Reuters 2025 Legal Department Operations Index makes this clear: data privacy concerns and accuracy risks are top barriers to client acceptance of AI-enabled services.

Framework alignment with NIST CSF 2.0 and the AI RMF gives firms a shared language with IT and clients for acceptance criteria. The NIST NCCoE working sessions on securing AI system components map AI risk areas to CSF subcategories, highlighting data security, identity and access control, and monitoring as priority mitigations.

My forecast: buyers will favor solutions that document data lineage, permissioning, and reconciliation to CRM dashboards. Firms that cannot answer "How do we audit this?" or "What happens if a client requests data deletion?" will face procurement roadblocks and reputational risk.

The emerging model: A governed relationship intelligence layer

I see the future taking shape around a specific architecture: keep CRM as the system-of-record, and add an AI layer to passively capture signals from unstructured data, generate relationship maps, and recommend business development actions and then write back governed updates to CRM. This model respects the need for auditability while delivering the efficiency gains that AI promises.

The attorney adoption fix is embedded in the design: "zero extra clicks" wherever possible, with insights embedded in familiar workflows like Outlook and Teams. Human-in-the-loop controls and transparent lineage build trust and satisfy compliance requirements. This approach aligns with the adoption pain points documented by LexisNexis InterAction and the integration challenges highlighted by ILTA.

My forecast horizon: 12 to 24 months of rapid maturation in enrichment, dedupe, and identity resolution. Broader replacement of system-of-record functions remains unlikely until auditability and accuracy mature further. McKinsey's findings on scaling limits, NIST's governance frameworks, and the Thomson Reuters client diligence data all point in the same direction. AI will elevate insight generation and reduce admin, but CRM remains essential for governance, reporting, and institutional memory.

What this means for law firms

The near-term forecast is clear: AI elevates insight generation and reduces admin, while CRM remains essential for governance, reporting, and institutional memory. Firms that architect a governed relationship intelligence layer on top of their system-of-record will enable adoption and deliver measurable wins. Those that chase the fantasy of a CRM-free future will find themselves unable to answer the questions their executive committees and clients will inevitably ask.

As you evaluate your next move, consider these prompts: What evidence will your executive committee and clients require before they approve AI on communications data? Where can passive capture deliver 90-day wins without compromising auditability? And how will you reconcile AI-generated insights back to the system-of-record your firm depends on?

The peer benchmarks and frameworks are already in place. ILTA for stack planning, McKinsey for realistic expectations on scaling, NIST for governance, and Thomson Reuters for client diligence. AI will transform relationship intelligence in law firms, but success depends on whether your firm architects that transformation with the governance and adoption discipline required to make it stick.